san francisco sales tax rate breakdown

The minimum combined 2022 sales tax rate for San Jose California is. Please contact the local office nearest you.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Those district tax rates range from 010 to 100.

. The statewide tax rate is 725. Sellers are required to report and pay the applicable district taxes for their taxable. The California sales tax rate is currently.

The County sales tax rate is. Most of these tax changes were approved by voters. Depending on local sales tax jurisdictions the total tax rate can be as high as 1025.

This rate includes any state county city and local sales taxes. Sales tax region name. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

This is the total of state county and city sales tax rates. Businesses impacted by the pandemic please visit our COVID-19 page. California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes.

For questions about filing extensions tax relief and more call. California Sales Tax. San Francisco CA Sales Tax Rate.

The true state sales tax in California is 6. What is the sales tax rate in San Jose California. The California sales tax rate is currently.

Average Sales Tax With Local. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

2022 List of California Local Sales Tax Rates. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. 4 rows The latest sales tax rate for San Francisco CA.

Lowered from 875 to 85 San Anselmo. An alternative sales tax rate of 9875 applies in the tax region Daly City which appertains to zip code 94080. There is no applicable city tax.

The minimum combined 2022 sales tax rate for San Francisco California is. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

Some areas may have more than one district tax in effect. Choose any state for more information including local and municiple sales tax rates is applicable. There are approximately 54126 people living in the South San Francisco area.

San Diego CA Sales Tax Rate. 2020 rates included for use while preparing your income tax deduction. Taxes collected shall be transmitted to the districts.

Online videos and Live Webinars are available in lieu of in-person classes. This tax does not all go to the state though. This rate includes any state county.

3 rows The latest sales tax rate for San Francisco County CA. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar. The sales and use tax rate varies depending where the item is bought or will be used.

Santa Ana CA Sales Tax Rate. The San Francisco County sales tax rate is 025. San Francisco Tourism Improvement District.

The California state sales tax rate is 725. This is the total of state county and city sales tax rates. State Sales Tax Rates 1 View local sales taxes by state.

The San Jose sales tax rate is. Those district tax rates range from 010 to 100. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

This rate includes any state. District tax areas consist of both counties and cities. For state use tax rates see Use Tax By State.

This is the total of state county and city sales tax rates. The South San Francisco California sales tax rate of 9875 applies to the following two zip codes. The latest sales tax rate for South San Francisco CA.

Lowered from 85 to 825. The state then requires an additional sales tax of 125 to pay for county and city funds. The latest sales tax rates for cities in California CA state.

The December 2020 total local sales tax rate was 9750. The total sales tax rate in any given location can be broken down into state county city and special district rates. Food and prescription drugs are exempt from sales tax.

Counties cities and towns in California may impose one or more district taxes. This rate is made up of a base rate of 6 plus California adds a mandatory local rate of 125 that goes directly to city and county tax officials. 2020 rates included for use while preparing your income tax deduction.

This scorecard presents timely information on economy-wide employment indicators real estate and tourism. Revenue and Taxation Code Section 7261. In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes.

San Jose CA Sales Tax Rate. The minimum sales tax in California is 725. A base sales and use tax rate of 725 percent is applied statewide.

SALES AND USE TAX RATES CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes. The San Francisco County Sales Tax is collected by the merchant on all. All in all youll pay a sales tax of at least 725 in California.

Lowest sales tax NA Highest sales tax 1075 California Sales Tax. 4 rows Sales Tax Breakdown. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

The San Francisco sales tax rate is. Rates include state county and city taxes. Over the past year there have been twenty local sales tax rate changes in California.

The County sales tax rate is. Did South Dakota v. There are a total of 473 local tax jurisdictions across the.

The minimum sales tax in California is 725. SAN FRANCISCO COUNTY 8625 SAN JOAQUIN COUNTY 775 City of Lathrop 875 City of Lodi 825 City of Manteca 825 City of Stockton 900.

California Sales Use Tax Guide Avalara

How Do State And Local Sales Taxes Work Tax Policy Center

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Us Sales Tax On Orders Brightpearl Help Center

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California Sales Tax Rates By City County 2022

California Sales Tax Rate By County R Bayarea

Understanding California S Sales Tax

California City County Sales Use Tax Rates

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

How Do State And Local Sales Taxes Work Tax Policy Center

Frequently Asked Questions City Of Redwood City

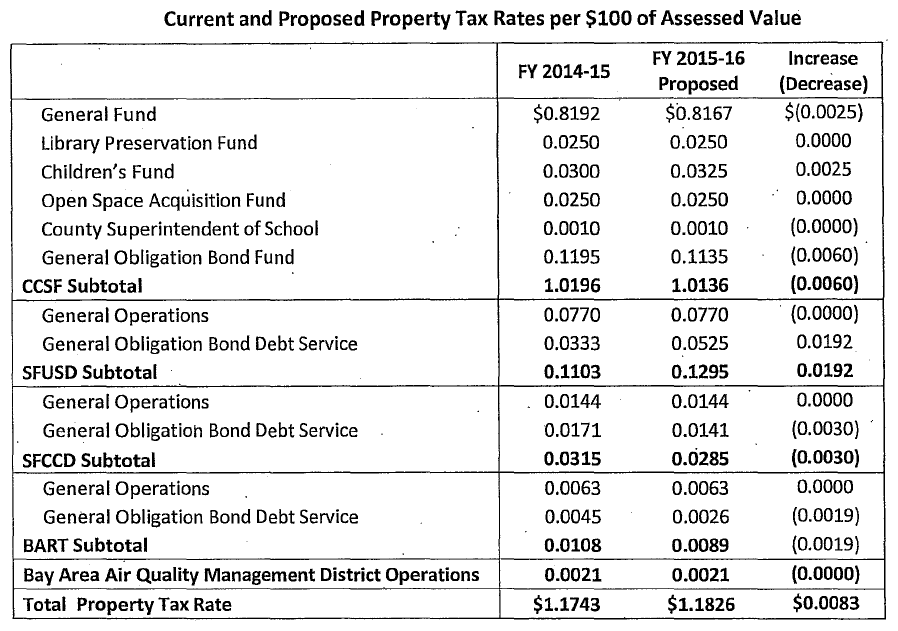

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

Understanding California S Sales Tax

Understanding California S Sales Tax

Understanding California S Sales Tax

Sales Tax Collections City Performance Scorecards

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate